Free AI Zerodha Brokerage Calculator

Calculate exact trading charges for Equity, F&O, Currency & Commodity segments. Get precise brokerage, STT, GST & other charges instantly.

Intraday Equity

How Zerodha Brokerage Calculator Works

Say goodbye to surprise fees with Zerodha’s Brokerage Calculator!

This easy-to-use online tool helps you estimate the total cost of your trade in seconds—across equity, intraday, futures, and options.

It breaks down every charge involved in a trade, including:

To use the calculator, just enter:

Instantly, you'll get:

This level of transparency helps both beginners and experienced traders plan trades more confidently.

For instance, if you're trading options, you'll know your exact cost even before placing the order.

Try it now to make smarter, cost-aware trading decisions!

How to Use Zerodha Brokerage Calculator Online

Using the Free Zerodha Brokerage Calculator and Zerodha Margin Calculator is fast and beginner-friendly.

Whether you're trading in intraday, delivery, futures, or options, this Zerodha calculator helps you know your costs and potential profit or loss in advance.

First, select your trade type: Intraday Equity, Delivery Equity, F&O – Futures, or F&O – Options.

🔽 Enter the Following:

📊 You'll Instantly See:

This real-time calculator removes guesswork and ensures full cost visibility before you trade.

Whether you're new to the market or a seasoned trader, it saves time and helps you plan smart, cost-aware trades.

Zerodha Brokerage Calculation Formulas

📈 Intraday Equity

STT: 0.025% on sell side only

Transaction Charges: NSE: 0.00297%, BSE: 0.00375%

SEBI Charges: ₹10 per crore

Stamp Duty: 0.003% on buy side

📊 Delivery Equity

STT: 0.1% on buy & sell

Transaction Charges: NSE: 0.00297%, BSE: 0.00375%

SEBI Charges: ₹10 per crore

Stamp Duty: 0.015% on buy side

📈 F&O - Futures

STT: 0.02% on sell side

Transaction Charges: NSE: 0.00173%, BSE: 0%

SEBI Charges: ₹10 per crore

Stamp Duty: 0.002% on buy side

📊 F&O - Options

STT: 0.1% on sell side (premium)

Transaction Charges: NSE: 0.03503%, BSE: 0.0325%

SEBI Charges: ₹10 per crore

Stamp Duty: 0.003% on buy side

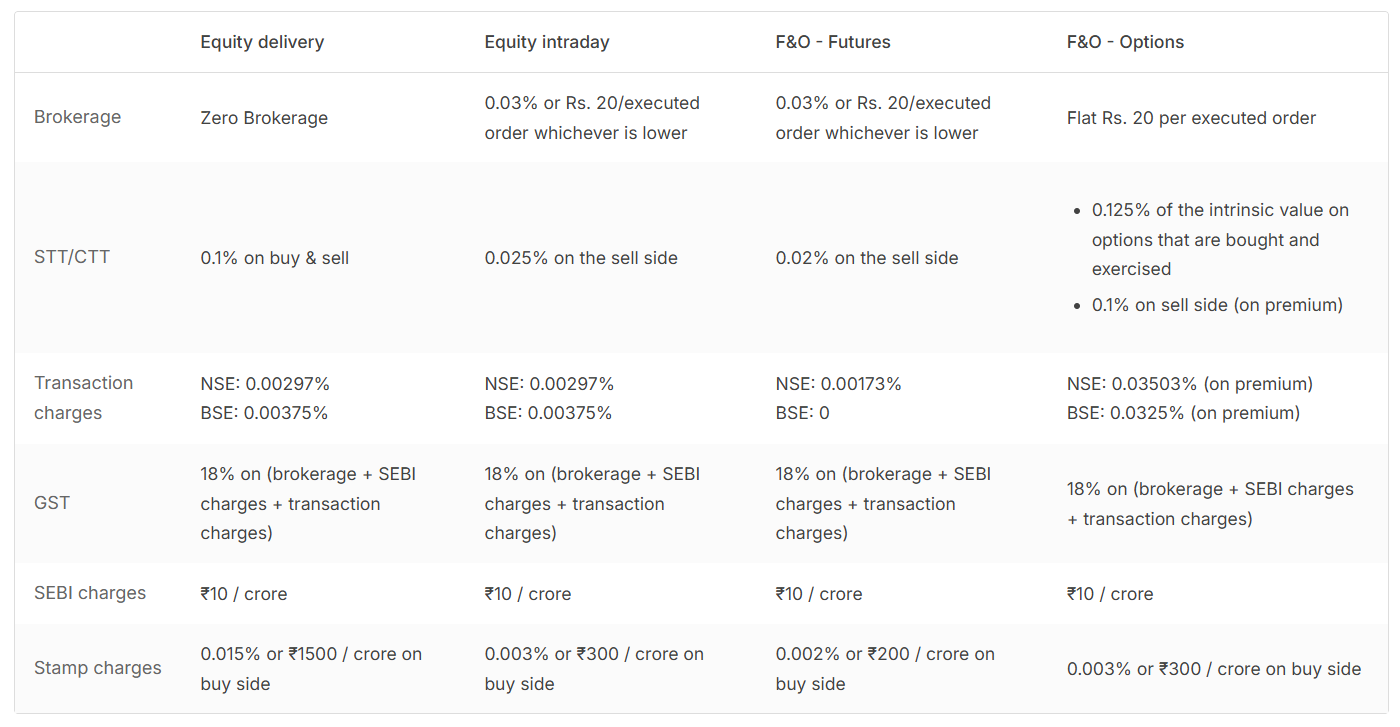

Zerodha Brokerage Charges For Intraday, Delivery, F&O - Futures & Options

You can view the official Zerodha charges here.

📉 Intraday Trading

- Brokerage: 0.03% or ₹20/executed order (whichever is lower)

- STT/CTT: 0.025% on sell side

- Transaction Charges: NSE: 0.00297%, BSE: 0.00375%

- GST: 18% on (brokerage + SEBI + txn charges)

- SEBI Charges: ₹10 / crore

- Stamp Charges: 0.003% or ₹300 / crore on buy side

📦 Delivery Trading

- Brokerage: Zero Brokerage

- STT/CTT: 0.1% on buy & sell

- Transaction Charges: NSE: 0.00297%, BSE: 0.00375%

- GST: 18% on (brokerage + SEBI + txn charges)

- SEBI Charges: ₹10 / crore

- Stamp Charges: 0.015% or ₹1500 / crore on buy side

📊 F&O - Futures

- Brokerage: 0.03% or ₹20/executed order (whichever is lower)

- STT/CTT: 0.02% on sell side

- Transaction Charges: NSE: 0.00173%, BSE: 0%

- GST: 18% on (brokerage + SEBI + txn charges)

- SEBI Charges: ₹10 / crore

- Stamp Charges: 0.002% or ₹200 / crore on buy side

📈 F&O - Options

- Brokerage: Flat ₹20 per executed order

- STT/CTT: 0.125% (exercised options), 0.1% on sell side (premium)

- Transaction Charges: NSE: 0.03503%, BSE: 0.0325%

- GST: 18% on (brokerage + SEBI + txn charges)

- SEBI Charges: ₹10 / crore

- Stamp Charges: 0.003% or ₹300 / crore on buy side

Difference Between Intraday, Delivery, F&O Futures & Options

Understanding the key differences between intraday, delivery, futures and options trading is crucial for selecting the right investment strategy.

Each trade type has its own risks, capital requirements, holding periods, and profit potential.

Use this guide to make smarter trading decisions on platforms like Zerodha.

📉 Intraday Trading

- Buy and sell stocks on the same day

- Used for short-term profits from price movements

- Brokerage: ₹20 or 0.03% (whichever is lower)

- High risk and requires active monitoring

- Margin trading available with leverage

📦 Delivery Trading

- Stocks held for more than one day

- Ideal for long-term investing and wealth creation

- Zero brokerage on Zerodha

- No margin or leverage involved

- Lower risk than intraday or F&O

📊 F&O - Futures

- Contract to buy/sell at a future price

- Used for hedging or speculative trading

- Requires higher margin and involves leverage

- Brokerage: ₹20 or 0.03%

- High volatility and risk management is essential

📈 F&O - Options

- Right to buy/sell, not obligation

- Best for limited risk with higher returns

- Premium paid is the maximum loss

- Brokerage: Flat ₹20 per executed order

- Can be used for income, hedging, or speculation

Zerodha vs Groww Brokerage Charges Comparison

Choosing the right trading platform involves understanding the brokerage charges and other fees.

Here’s a detailed comparison between Zerodha and Groww to help you make an informed decision.

| Charge Type | Zerodha | Groww |

|---|---|---|

| Equity Delivery - Brokerage | Zero Brokerage | Zero Brokerage |

| Equity Delivery - STT/CTT | 0.1% on buy & sell | 0.1% on buy & sell |

| Equity Delivery - Transaction Charges | NSE: 0.00297%, BSE: 0.00375% | NSE: 0.00297%, BSE: 0.00375% |

| Equity Delivery - Stamp Charges | 0.015% or ₹1500/crore on buy side | 0.015% on buy side |

| Equity Intraday - Brokerage | 0.03% or ₹20/executed order (lower) | 0.01% or ₹20/executed order (lower), min ₹5 |

| Equity Intraday - STT/CTT | 0.025% on sell side | 0.025% on sell side |

| Equity Intraday - Transaction Charges | NSE: 0.00297%, BSE: 0.00375% | NSE: 0.00297%, BSE: 0.00375% |

| Equity Intraday - Stamp Charges | 0.003% or ₹300/crore on buy side | 0.003% on buy side |

| F&O Futures - Brokerage | 0.03% or ₹20/executed order (lower) | ₹20 per executed order |

| F&O Futures - STT/CTT | 0.02% on sell side | Not specified in Groww's data |

| F&O Futures - Transaction Charges | NSE: 0.00173%, BSE: 0 | Not specified in Groww's data |

| F&O Options - Brokerage | Flat ₹20 per executed order | ₹20 per executed order |

| F&O Options - STT/CTT | 0.125% on intrinsic value (exercised), 0.1% on sell side (premium) | Not specified in Groww's data |

| F&O Options - Transaction Charges | NSE: 0.03503% (premium), BSE: 0.0325% (premium) | Not specified in Groww's data |

| DP Charges (per sell transaction) | ₹15.34 per scrip | ₹3.5 (male), ₹3.25 (female) |

| Account Maintenance Charges (AMC) | ₹300/year + 18% GST (non-BSDA) | Zero charges |

Key Takeaways: