Sukanya Samriddhi Yojana (SSY) Calculator 2026 – Calculate Maturity Amount

Calculate your daughter's bright future with SSY investment planner. Get instant maturity amount, interest earned, investment growth chart, and year-wise breakdown.

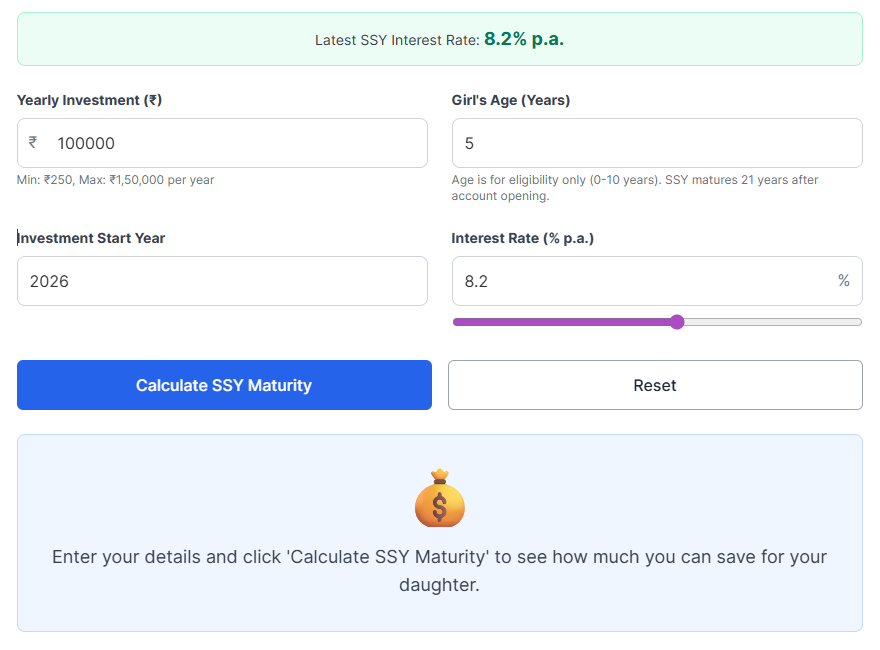

Min: ₹250, Max: ₹1,50,000 per year

Age is for eligibility only (0-10 years). SSY matures 21 years after account opening.

Investment Growth Chart

Year-wise Breakdown

| Year | Age | Opening Balance | Deposit | Interest | Closing Balance |

|---|

Enter your details and click 'Calculate SSY Maturity' to see how much you can save for your daughter.

Sukanya Samriddhi Yojana (SSY) Calculator 2026

The Sukanya Samriddhi Yojana (SSY) Calculator is a free and easy-to-use online tool designed for parents who want to plan a secure financial future for their girl child.

It instantly estimates the maturity amount, total interest earned, and total investment based on the latest SSY interest rate announced by the Government of India.

SSY currently offers one of the highest returns among government-backed savings schemes with an attractive

8.2% per annum interest rate (compounded annually).

Last Updated: 7-12-2025

This calculator helps you understand how much wealth you can create over 21 years and how yearly contributions grow using the power of compounding.

Whether you’re planning for higher education or long-term savings, the SSY calculator gives you accurate projections and helps you decide the ideal yearly investment to achieve goals like building a ₹15 Lakh, ₹25 Lakh, ₹50 Lakh, or ₹1 Crore maturity corpus tax-free.

Why Use This SSY Calculator?

✔ Accurate results using the official SSY compound interest formula

✔ Clear breakdown of maturity amount, total interest earned, and total deposits

✔ Includes year-wise growth table and investment chart for better planning

✔ Helps compare SSY returns with PPF, FD, and other savings schemes

This calculator is especially helpful for Indian parents who want clarity, transparency, and confidence before investing in Sukanya Samriddhi Yojana.

How to Use the SSY Calculator Online?

You don’t need any financial expertise—just enter a few basic details, and the tool will compute the complete SSY maturity projection for you. Here’s how:

- Enter Yearly Investment: Choose any amount between ₹250 and ₹1,50,000 per year.

- Enter Girl’s Age: Enter the current age (must be between 0 to 10 years).

- Select Start Year: Pick the financial year in which you plan to begin the investment.

- Adjust Interest Rate: 8.2% is the current SSY rate, but you can adjust it to explore different scenarios.

- Click “Calculate SSY Maturity” to view detailed results and growth charts.

Smart Tip: To maximize returns, try to deposit before 5th April every year. This ensures you earn interest for the full financial year.

The results displayed include the Maturity Year, Total Investment, Total Interest Earned, and Final Maturity Amount payable after 21 years. A complete year-wise breakdown table and chart help you track how your investment grows consistently over time.

🔗 Explore More Finance Tools

SSY Calculator Formula — How the Maturity Amount Is Calculated

The Sukanya Samriddhi Yojana calculator uses a two-step compounding method to calculate the final maturity amount. The SSY scheme has deposits for the first 15 years, and then the entire balance compounds further until the 21-year maturity period.

Basic Compound Interest Formula:

A = P × (1 + r/n)n × t

Where:

• A = Amount after compounding

• P = Principal (deposit amount)

• r = Annual interest rate

• n = Compounding frequency (SSY = yearly, so n = 1)

• t = Time period in years

SSY calculations are not limited to this single formula because deposits are made only for 15 years, while the account matures after 21 years. Therefore, the calculator applies the SSY-specific two-step logic shown below.

Two-Step SSY Calculation Method:

Step 1: 15 Years of Yearly Deposits

Each yearly deposit compounds using the formula above. Every contribution grows at 8.2% per annum until the end of the 15th year.

Step 2: Remaining 6 Years of Growth (No Deposits)

After 15 years, the total accumulated balance is treated as a lump sum amount and compounds further for 6 more years:

Final Maturity = Balance_after_15_years × (1 + r)6

This two-step logic ensures accurate SSY maturity calculations — matching the official scheme structure where deposits stop after 15 years but interest continues until the 21-year maturity.

Year-wise SSY Growth Example

Here’s a simple example. If you invest ₹1,00,000 every year for 15 years at an interest rate of 8.2% per annum:

- • Total Investment: ₹15,00,000

- • Estimated Maturity Value: Around ₹47–48 lakh

- • Total Interest Earned: Approximately ₹32–33 lakh

- • Account Duration: 21 years

This is an approximate value based on the current interest rate. Actual maturity may vary depending on future SSY rate revisions.

Current Sukanya Samriddhi Yojana Interest Rate (2025–2026)

The interest rate for the Sukanya Samriddhi Yojana (SSY) is reviewed every quarter by the Government of India under the Small Savings Scheme. SSY consistently ranks among the highest interest-paying government-backed schemes, making it a preferred choice for long-term savings for a girl child.

⭐ Current SSY Interest Rate (2025–2026): 8.2% per annum

*(Compounded annually as per the latest Ministry of Finance circular)*

This interest rate directly affects your maturity amount. Even a small increase or decrease can significantly impact the final value over a 21-year period. To help you understand how SSY rates have changed over the years, here is a complete historical interest rate table.

| Period | SSY Interest Rate |

|---|---|

| July – September 2024 (Q2 2024–2025) | 8.2% |

| April – June 2024 (Q1 2024–2025) | 8.2% |

| January – March 2024 (Q4 FY 2023–24) | 8.2% |

| October – December 2023 (Q3 FY 2023–24) | 8.0% |

| July – September 2023 (Q2 FY 2023–24) | 8.0% |

| April – June 2023 (Q1 FY 2023–24) | 8.0% |

| January – March 2023 (Q4 FY 2022–23) | 7.6% |

| October – December 2022 (Q3 FY 2022–23) | 7.6% |

| July – September 2022 (Q2 FY 2022–23) | 7.6% |

| April – June 2022 (Q1 FY 2022–23) | 7.6% |

| January – March 2022 (Q4 FY 2021–22) | 7.6% |

| October – December 2021 (Q3 FY 2021–22) | 7.6% |

| July – September 2021 (Q2 FY 2021–22) | 7.6% |

| April – June 2021 (Q1 FY 2021–22) | 7.6% |

| January – March 2021 (Q4 FY 2020–21) | 7.6% |

| October – December 2020 (Q3 FY 2020–21) | 7.6% |

| July – September 2020 (Q2 FY 2020–21) | 7.6% |

| April – June 2020 (Q1 FY 2020–21) | 7.6% |

| January – March 2020 (Q4 FY 2019–20) | 8.4% |

| October – December 2019 (Q3 FY 2019–20) | 8.4% |

| July – September 2019 (Q2 FY 2019–20) | 8.4% |

| April – June 2019 (Q1 FY 2019–20) | 8.5% |

| January – March 2019 (Q4 FY 2018–19) | 8.5% |

| October – December 2018 (Q3 FY 2018–19) | 8.5% |

| July – September 2018 (Q2 FY 2018–19) | 8.1% |

| April – June 2018 (Q1 FY 2018–19) | 8.1% |

| January – March 2018 (Q4 FY 2017–18) | 8.1% |

| October – December 2017 (Q3 FY 2017–18) | 8.3% |

| July – September 2017 (Q2 FY 2017–18) | 8.3% |

| April – June 2017 (Q1 FY 2017–18) | 8.4% |

These historical rates highlight how SSY has remained a stable and high-yield investment option over the years. Our calculator automatically uses the latest rate to ensure accurate maturity and interest projections.

Key Features and Benefits of SSY Scheme

The Sukanya Samriddhi Yojana (SSY) is one of India’s most trusted long-term investment schemes for securing a girl child’s financial future. It combines high returns, tax savings, and guaranteed maturity benefits backed by the Government of India.

High Interest Rate

SSY offers an attractive interest rate of 8.2% per annum, one of the highest among all government-backed savings schemes in India.

Guaranteed Maturity

The investment matures after 21 years from the date of account opening, ensuring a secure lump-sum amount for higher education or marriage.

Low Minimum Deposit

Start saving with as little as ₹250 per year, making SSY accessible for families across all income levels.

Tax-Free Returns (EEE)

SSY enjoys EEE status — your contribution, interest earned, and maturity amount are all 100% tax-free.

Tax Benefits Under Section 80C (EEE Status)

SSY provides one of the best tax-saving advantages under Indian law. Your yearly contribution of up to ₹1.5 lakh qualifies for deduction under Section 80C. Additionally, the scheme follows the rare EEE (Exempt-Exempt-Exempt) tax structure:

- ✔ Exempt Contribution: Deposits qualify for 80C deduction.

- ✔ Exempt Interest: Interest earned is completely tax-free.

- ✔ Exempt Maturity: Final maturity amount is 100% tax-free.

Eligibility Criteria for Opening an SSY Account

To open an SSY account, the following eligibility rules apply:

- ✔ The account can be opened only for a girl child.

- ✔ The child must be an Indian resident.

- ✔ The girl should be below 10 years of age at the time of opening the account.

- ✔ Only one account per girl child is allowed.

- ✔ A family can open SSY accounts for a maximum of two girl children.

Minimum and Maximum Deposit Limits (₹250 to ₹1.5 Lakh)

The SSY scheme is flexible and affordable, making it suitable for all financial backgrounds. The deposit rules are as follows:

- ✔ Minimum Deposit: ₹250 per year

- ✔ Maximum Deposit: ₹1,50,000 per year

- ✔ Deposits can be made multiple times in a year

- ✔ Deposits are allowed only for the first 15 years from account opening

SSY vs PPF — Which Scheme Is Better in 2026?

Both Sukanya Samriddhi Yojana (SSY) and Public Provident Fund (PPF) are popular long-term savings schemes in India.

While both offer guaranteed returns and tax benefits, they serve different financial goals. Here’s a clear and modern comparison to help you decide which investment suits your needs in 2026.

💡 Quick Insight: SSY offers a higher interest rate and a targeted benefit for a girl child, while PPF is more flexible and suitable for general long-term savings.

| Feature | SSY (Sukanya Samriddhi) | PPF (Public Provident Fund) |

|---|---|---|

| Current Interest Rate (2026) | 8.2% per annum | 7.1% per annum |

| Who Can Open? | Parents of a girl child below 10 years | Any Indian citizen |

| Deposit Limit | ₹250 – ₹1.5 lakh per year | ₹500 – ₹1.5 lakh per year |

| Lock-in Period | 21 years | 15 years |

| Premature Withdrawal | Allowed after 18 years (education/marriage) | Partial withdrawals after 7 years |

| Tax Benefits | EEE Status (100% tax-free) | EEE Status (100% tax-free) |

| Best Suited For | Long-term savings for a girl child | General long-term savings for everyone |

Final Verdict: Choose SSY if you're planning for your daughter’s future with higher returns. Choose PPF if you want a flexible, long-term, low-risk investment open to all Indian residents.

Premature Withdrawal Rules and Maturity Period

The Sukanya Samriddhi Yojana comes with clear withdrawal and maturity guidelines, designed to support long-term financial security for a girl child. Understanding these rules helps parents make informed planning decisions.

Withdrawal Allowed After Age 18

Partial withdrawal of up to 50% of the account balance is allowed once the girl child turns 18 years old.

This withdrawal can be used for:

✔ Higher education

✔ Skill development

✔ Professional courses

Full Maturity at 21 Years

The SSY account matures after 21 years from the date of opening. After maturity, the entire balance — including principal + interest — becomes fully withdrawable without any tax.

No Deposits After 15 Years

Deposits are required only for the first 15 years. After that, the balance continues to earn compound interest until the 21-year maturity period ends.

Account Can Continue Even After 21 Years

If no withdrawal is made after maturity, the account continues to earn interest at the prevailing SSY rate until the final closure.

Why Use Our Free SSY Calculator?

The official SSY calculation involves multiple compounding rules, yearly deposit adjustments, and interest updates. Our Free SSY Calculator simplifies everything — giving you fast, accurate, and realistic maturity projections based on the latest government data.

Real-Time Accuracy: Uses the current SSY interest rate (8.2% p.a.) with precise annual compounding.

Two-Phase SSY Calculation: Automatically handles 15 years of deposits + 6 years of compound growth to compute exact maturity.

Year-Wise Growth Breakdown: View detailed tables and charts showing how your balance grows every financial year.

Compare Returns: Instantly compare SSY returns with options like PPF, FD, and other savings schemes.

Tax-Free Growth Insight: See how your deposit grows completely tax-free under the EEE tax structure.